MIDFLORIDA Credit Union, located in Lakeland, Florida, is celebrating another year of growth in its educational outreach efforts, reaffirming its long-standing belief that financial literacy is essential to the well-being of the communities it serves. With studies showing that fewer than one in three Americans can confidently answer basic financial questions, the credit union continues to expand its programs to ensure individuals of all ages have access to the tools and guidance they need to make informed financial decisions. As MIDFLORIDA Credit Union grows, so does its dedication to education- an effort rooted in its mission as a member-owned cooperative.

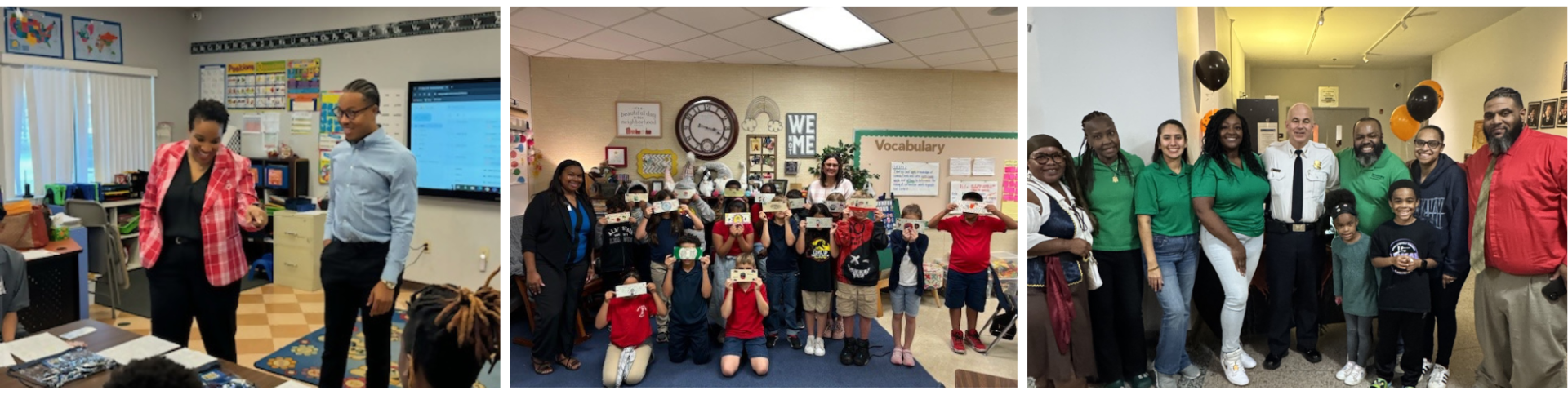

This year, MIDFLORIDA Credit Union’s Gift of Reading program once again demonstrated how small acts can create lasting impact. Launched in 2006, the program has grown alongside the credit union and now reaches more children each year. In its most recent season, 151 employees visited more than 1,300 classrooms across 281 schools, sending 28,000 students’ home with a new book of their own. With more than half a million children reached since its inception, the program continues to cultivate a love of reading that can build strong educational foundations for years to come.

In addition to its work inside classrooms, MIDFLORIDA Credit Union is expanding how, and where, it provides financial education. The newly launched MIDFLORIDA Makes Cents podcast reflects the credit union’s commitment to meeting members where they are. Featured on Amazon, Spotify, and Apple Podcasts, the show offers practical and accessible financial guidance in a format that fits into the busy, mobile lives of today’s consumers. The podcast underscores the credit union’s mission to stay current, relevant, and responsive to the evolving ways people seek information.

MIDFLORIDA Credit Union’s free online learning platform, Money Minute, also continues to gain momentum. With more than 1,200 registered users and 40,000 visits, the platform has quickly become a trusted resource for individuals seeking easy-to-understand financial education. Users have completed more than 700 courses, with scholarship guidance and credit education ranking among the most popular topics, highlighting the community’s desire for accessible, real-world financial support.

Beyond digital learning, MIDFLORIDA Credit Union employees remain deeply engaged in face-to-face educational outreach. This year, staff members facilitated more than 180 workshops in the community, reaching over 10,000 attendees with lessons designed to improve confidence in managing everyday finances. These sessions reflect the credit union’s belief that education is most impactful when it is personal, practical, and rooted in real conversations.

To support younger audiences, MIDFLORIDA Credit Union hosts Teen Night events annually at each branch location, giving teens an opportunity to explore the world of banking in a relaxed, welcoming environment. These events help build early financial habits and foster relationships that will grow with teens as they move into adulthood, further reinforcing the credit union’s long-term commitment to financial preparation and empowerment.

“As we continue to grow, our responsibility to our members and our community grows with us,” said Vanessa Hernandez, Chief of Retail. “Education is at the core of who we are as a credit union, and we remain dedicated to expanding our efforts, so every individual has the knowledge and confidence to build a solid financial future.”

MIDFLORIDA Credit Union plans to continue investing in educational programs that reach people at every stage of life, strengthening the financial well-being of communities across Florida.